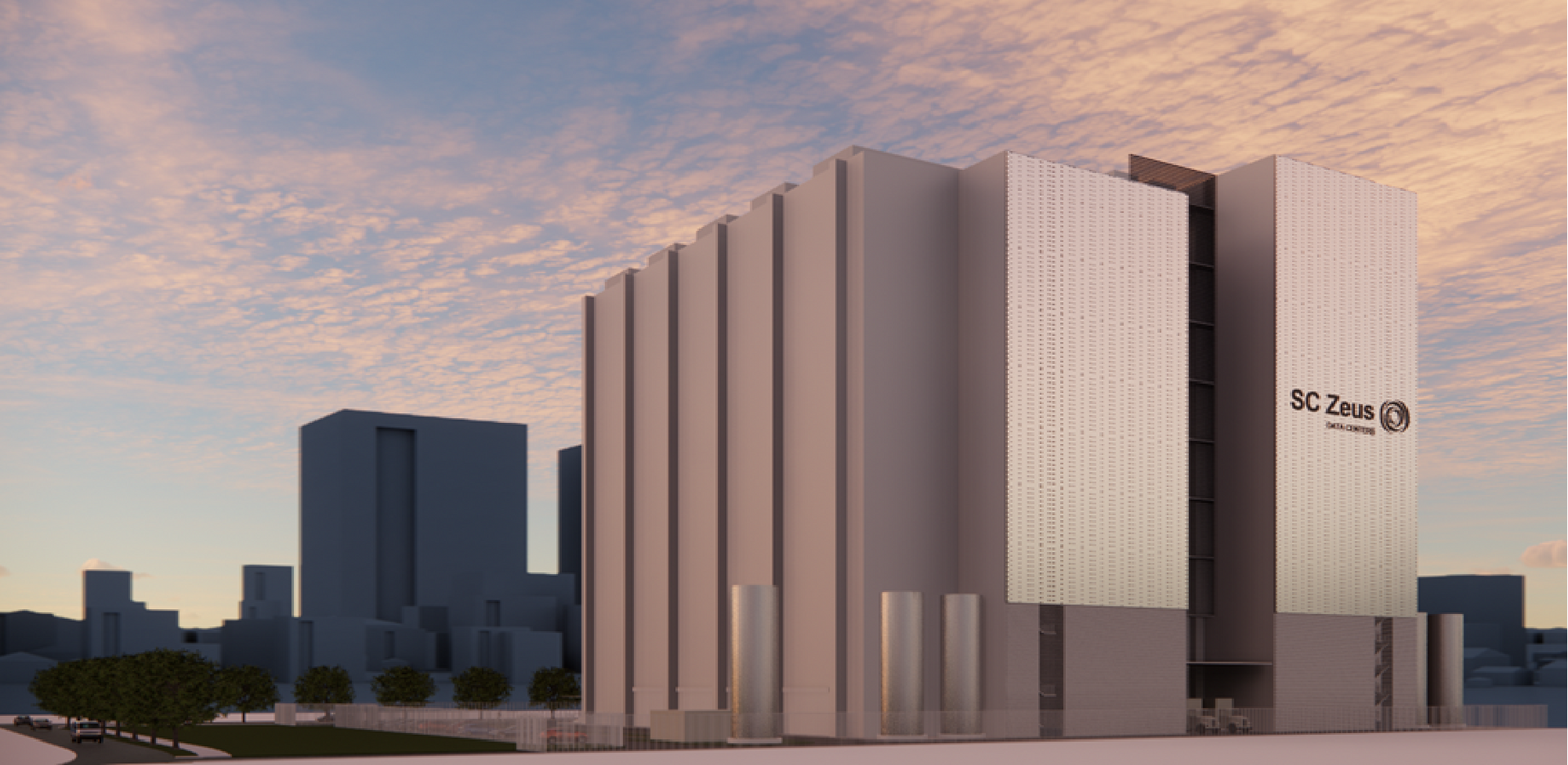

Powering the AI Era

Powering the AI Era: SC Zeus and the New Architecture of Digital Infrastructure

As the global digital economy accelerates and AI reshapes every sector, data centers have transformed from silent back-end utilities into strategic infrastructure central to national competitiveness. Investors increasingly recognize the sector’s critical importance — yet they continue to grapple with concerns around exit optionality, tenant concentration, sustainability obligations, supply-chain volatility, and a rapidly intensifying battle for power.

In this landscape of structural uncertainty and unprecedented demand, SC Zeus offers a clear perspective: the industry has entered the era of megawatt dreaming — where power availability, scalable architecture, and resilient execution will determine the next generation of winners.

In a recent dialogue with Institutional Real Estate Asia Pacific (IREI), SC Zeus CEO Joe Gooi shared his vision for the future of digital infrastructure and the strategic pathways investors can take to capture long-term value in an increasingly AI-driven world.

1. Data Centers Are Becoming AI-First Ecosystems

“We’ve moved into an era where data centres are no longer standalone buildings — they are adaptive ecosystems,” Joe says.

This shift is most visible across the Asia-Pacific region, where investor preferences have rapidly evolved from single-facility deployments to large-scale, multi-phased campuses designed expressly for hyperscale and AI workloads. In these markets, the traditional constraints around land availability have been replaced by something far more acute: the scarcity of power.

For SC Zeus, this reality forms the foundation of its development strategy. Whether in Japan, South Korea, or Thailand, each project begins with secured, long-term power agreement, enabled by deep utility partnerships and close collaboration with local authorities. Facilities are engineered for phased delivery to maximize speed-to-market and built high-density and liquid-ready from day one.

“It’s no longer about who can build the largest facility,” Joe notes. “It’s about who can deliver the right megawatts, in the right place, at the right time.”

2. AI Is Redefining the Data Centre — and Raising the Bar

AI is not simply increasing demand; it is fundamentally redefining what a data centre is. Traditional densities of 5–10kW per rack are rapidly giving way to AI racks drawing 30–80kW or more. The implications cascade across every dimension — power distribution, cooling methodologies, structural engineering, and the long-term upgrade pathways that determine whether an asset remains relevant or becomes obsolete.

“AI doesn’t just run inside the data centre — it redefines what a data centre is,” Joe explains. “If you don’t design for AI from day one, obsolescence begins on day one.”

Data centers evolve not just in their planning but in practical terms while they function. AI will not only produce the demand for the data centre but also shape it in practical terms. “Tomorrow's facilities must act less like static buildings and more like AI-optimised organisms,” explains Joe. While SC Zeus builds with a 20-year lifecycle in mind, it engineers each campus with modular, upgrade-ready infrastructure so that the facility can adapt to new demands in five to ten years as technology advances in unexpected ways.

Building on this philosophy, SC Zeus designs its electrical and cooling systems to be inherently flexible — liquid-ready, density-scalable, and capable of being upgraded without major reconstruction. This ensures long-term relevance for customers and investors even as AI accelerates technical requirements faster than any sector has seen before.

3. Rethinking Investor Priorities in a Complex Market

As the digital infrastructure sector matures, institutional investors have become increasingly focused on structural risks and long-term resilience. Joe believes these concerns — around exit pathways, concentration exposure, and decarbonization — are not obstacles but levers that can unlock stronger returns when managed intentionally.

SC Zeus incorporates exit flexibility from the earliest design stages, allowing assets to be held, partially recycled, securitized, or sold at the platform or portfolio level depending on market conditions. Tenant concentration is mitigated through a campus-based operating model that supports multi-hall, multi-tenant distributions, enabling a healthy mix of hyperscale, cloud, and enterprise AI users.

Sustainability is treated as a shared commitment with customers. Long-term renewable PPAs, high-efficiency and liquid-ready designs, and transparent reporting frameworks ensure that climate responsibility is integrated into the commercial and operational fabric of each project.

“The concerns investors raise are the very factors that can create more durable value when you address them deliberately,” Joe says.

4. Power Constraints Are Real — but Sustainability Remains Non-Negotiable

The global surge in cloud and AI demand has placed intense pressure on national grids, leading some to suggest that decarbonization ambitions may need to be deprioritized. Joe strongly disagrees.

“In constrained markets, the temptation is to grab any power available. But sustainability and availability don’t have to be in conflict.”

SC Zeus follows a “secure power first — clean power next” approach. It begins by locking in reliable long-term power supply through utility-aligned substation developments, strengthened by close coordination with regional authorities. Once secured, the company layers in renewable sources, whether through on-site or adjacent generation or long-duration renewable energy contracting. The result is a model that both stabilizes grid capacity and advances decarbonization goals.

“We don’t just consume megawatts,” Joe adds. “We add capacity to the grid responsibly.”

5. The Convergence of Digital Infrastructure and Energy Transition

Joe believes the next frontier of investment lies at the intersection of digital infrastructure and the energy transition. Data centers are increasingly acting as anchor nodes within a broader ecosystem that includes renewable generation, battery storage, microgrids, district cooling, and waste-heat recovery.

For SC Zeus, this integrated approach — what the company calls its Digital-Plus Ecosystem — strengthens ESG outcomes while generating diverse and stable income streams. Instead of viewing energy as an external input, it becomes part of the value chain, ensuring every delivered megawatt comes with a long-term sustainability plan.

6. Execution as a Strategic Advantage

Regulatory and geopolitical pressures across APAC have made execution — not just planning — a defining competitive advantage. Power approvals are increasingly prioritised for strategic industries, and long-lead equipment such as transformers and high-voltage gear has become a critical bottleneck.

SC Zeus addresses these challenges by pre-ordering essential components, reinforcing supply-chain resilience through diversified vendor networks, and maintaining deep local partnerships in each market.

“The window to secure AI-ready capacity is closing,” Joe stresses. “The players who combine secured power with resilient supply chains will define the next decade.”

7. A New Understanding of “Core” in the Age of AI

As global capital competes aggressively for stabilized, AI-ready assets in Tier 1 markets, pricing continues to reflect not inflation - but the scarcity of predictable, long-duration digital cash flows. Joe believes the definition of “core” itself is evolving. Future core assets will be those that are liquid-ready, density-flexible, and able to accommodate multiple generational shifts in computing.

SC Zeus builds this philosophy into every campus. Its Osaka development, for instance, is being positioned as one of the most strategic AI-ready assets in central Osaka — a natural fit for global REITs, sovereign funds, and long-horizon institutional investors.

Joe says the defining feature of next-generation data centers is not just what happens inside the building, but how they shape and integrate with the communities around them. “We have moved into an era where data centers are no longer stand-alone buildings,” Gooi says. “They are becoming adaptive ecosystems — living infrastructure at the heart of the AI economy. The winners will be those who can deliver compute and power with the precision of a just-in-time supply chain.”

As the conversation concluded, Joe offered three reflections that encapsulate SC Zeus’s vision.

First, the definition of “core” is changing rapidly. Assets must be engineered with flexibility and density evolution at the forefront.

Second, execution — particularly around power, partnerships, and supply chains — is becoming the most decisive differentiator in the sector.

And third, the future belongs to integrated ecosystems that extend beyond the data centre fence line, linking digital infrastructure directly with energy generation, storage, and sustainability pathways.

In a world driven by AI and constrained by power, megawatt dreaming is more than a strategy — it is a blueprint for the digital infrastructure of the next decade.

IREI Interview link:

https://irei.com/publications/article/megawatt-dreaming-as-the-ai-economy-reshapes-data-center-need…